nj electric car tax credit 2021

Nj Electric Car Tax Credit 2021 New Jersey Approves 5 000 Ev Rebate Charging Infrastructure Electric Transit. MUD customers include residents and commercial.

Electric Vehicle Program Pse G

Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives.

. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Residential installation can receive a credit of up to 1000. For purchases on or after Jan 1 2021 the income requirement is up to 400 of the federal poverty guideline.

The chart to the left shows how the number of electric vehicles registered in New Jersey has. As of December 2021 there were fewer than 65000 state records show. Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

The credit begins to phase out for a manufacturer when that. Sales and Use Tax Exemption. Zero Emissions Vehicle ZEV drivers are exempt from the NJ sales tax.

Audi 2021 e-tron 222. After the failure of the Build Back Better bill in late 2021 the existing proposals for the. 0 0 You Save 4366 58400.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission. Yes the state of New Jersey has a tax credit for electric car drivers. For the Charge Ahead rebate option.

The credit begins to phase out for a manufacturer when that manufacturer sells. Federal Tax Credit Up To 7500. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of their cars depending on the.

Plenty of Space and Good Looks Explore the 2022 Chevrolet Bolt EUV. NJBPU Launches Year 2 of Popular Charge Up New Jersey Electric Vehicle Rebate Program 0762021 Beginning Today Customers Can Receive up to 5000. Ad Learn More about the All Electric 2022 Chevrolet Bolt EUV on the Official Chevy Site.

Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after. On or after Jan. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Though 4000 may be plenty if the federal government is going to boost the tax incentive NJ. Up to 90 of eligible costs. It sounds like that didnt happen.

Answered on Jul 19 2022. On January 17 2020 Governor. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

IRS or federal tax credits by. The credit amount will. Plug-in Electric Drive Vehicle Credit.

Up to 50 of eligible costs. Nj Electric Car Tax Credit 2021 New Jersey Approves 5 000 Ev Rebate Charging Infrastructure Electric Transit. New Jerseys ChargeUp electric vehicle rebate program is an unqualified success.

Overnight Test Drives With The 2021 Ford Mustang Mach E Old Bridge Nj

Jeep 4xe Hybrid Tax Credits Incentives By State

N J Doesn T Have Enough Places To Charge Electric Vehicles A New Plan Would Allow 1 In Every Town Nj Com

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Electric Vehicle Readiness Plan Somerset County

Can You Really Shave 25 000 Off The Price Of An Electric Car

2020 Nj Resident Ev Buyers Gets 5 000 In Tax Rebate And No Sales Tax R Teslamotors

Charged Up For An Electric Vehicle Future Pirg

Can You Really Shave 25 000 Off The Price Of An Electric Car

New Jersey Offering 5 000 Off Evs Getjerry Com

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

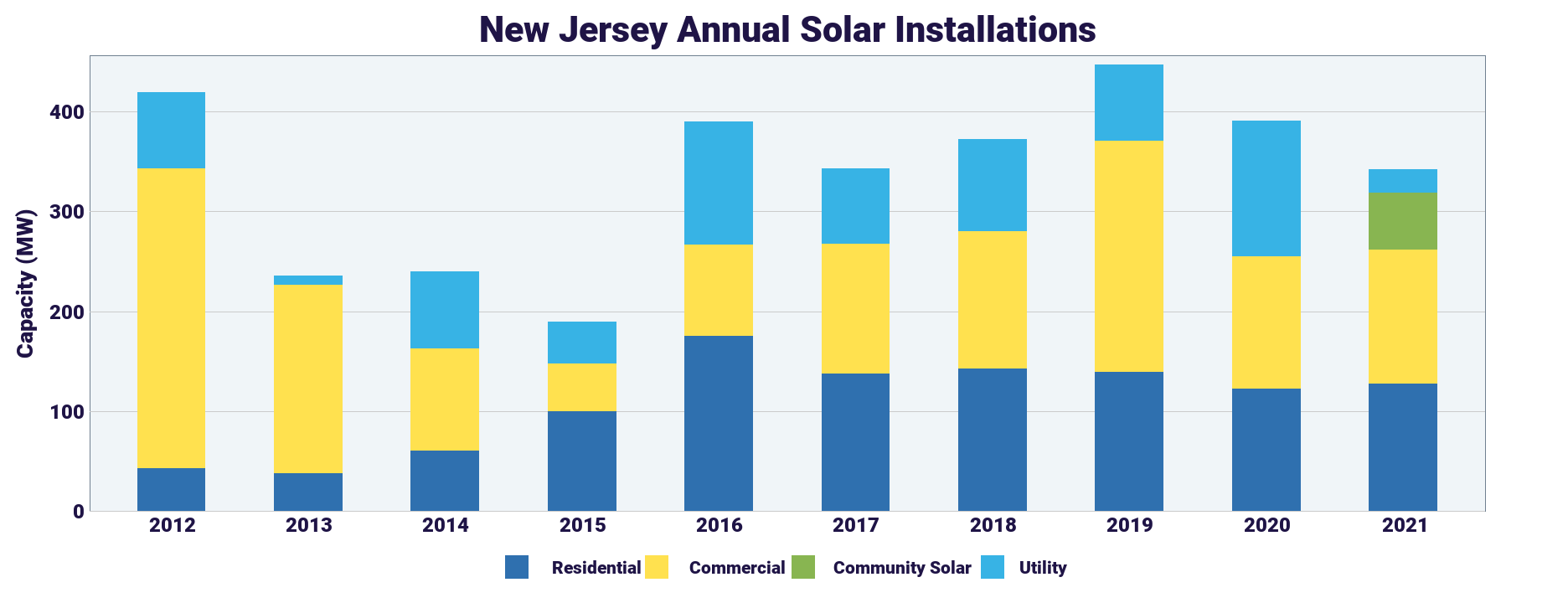

50 States Of Solar Incentives New Jersey Pv Magazine Usa

Learn About The Potential Federal Tax Credit On Your New 2021 Nissan Leaf

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Federal Tax Credits For Electric Cars In 2021 Can Save You Thousands

Electric Vehicle Planning For Businesses Hotels Apartments And More Greater Mercer Tma